The way in which banks react to climate risks and uncertainty could impact financial stability as well as the world’s transition to a low-carbon economy. A new study by researchers from IIASA and the Vienna University of Economics and Business explored the role that banks’ expectations about climate-related risks will play in fostering or hindering an orderly low-carbon transition.

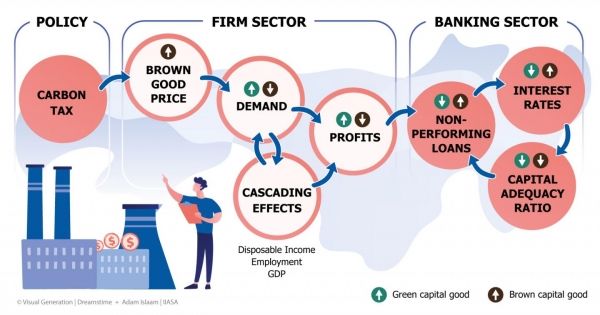

According to the study published in a special issue on climate risks and financial stability of the Journal of Financial Stability, banks and their expectations about climate-related risks – and especially climate transition risk stemming from a disorderly introduction of climate policies – play an important role in the successful transition to a low-carbon economy, as lower credit costs could make green (low-carbon) investments more competitive, allowing such investments to be made at scale. Depending on the timing and structure of implementation, climate policies could however also lead to a reduced profitability of brown (carbon intensive) firms, in turn leading to unanticipated loan defaults by such companies. This could pose a credit-risk for banks and investors, potentially threatening financial stability and leading to a credit crunch that would also affect green firms negatively, thus putting the success of an orderly low-carbon transition at risk.

The authors explain that they set out to assess the role of banks’ expectations about climate-related risks – climate sentiments – in fostering or hindering the low-carbon transition.

Read more at International Institute for Applied Systems Analysis

Image: Climate policies, transition risk, and financial stability (Credit: Adam Islaam | International Institute for Applied Systems Analysis (IIASA))